Market Summary: 1Q-2022

Rising Tensions as the Iron Curtain Lowers Again

Coming into the new year, we guessed market fluctuations would be determined by developments on COVID, inflation, and the evolution to tighter fiscal and monetary policy. This was quickly derailed by what many feared might turn into World War III. The Russian invasion of Ukraine caused some commodity prices to jump on fears of supply disruption. The ensuing economic backdrop of further inflation, a more hawkish Federal Reserve, less accommodative fiscal policy, a global supply chain that remains fragile, and geopolitical tensions created a period of historic uncertainty.

Global stocks sold off and volatility spiked. By signaling their intention to hike interest rates, the Fed caused rates to rise (causing bond prices to fall), leaving few safe havens for investors. The only segments higher on the quarter were value stocks (particularly energy and utilities) and alternatives. However, as the Ukrainian army defied military experts’ predictions of an easy takeover, and the war dragged on, Western sanctions began to impact the Russian economy.

Despite all the uncertainty endured in the quarter, there are a few silver linings in the events that happened:

- A more unified NATO coalition. NATO members are now increasing their military budgets and reducing their ties with Russia. Putin has undermined in weeks most of the progress Russia has made over decades.

- Russian military mystique is gone. Russia’s underperforming military has been exposed as a declining power. For Russia, this is already causing military defections and “brain drain” (intelligent, successful Russian citizens fleeing their own country for fear of economic collapse). A weakened Russia could lead to a more peaceful, stable post-war Europe.

- Military imperialism dealt a setback. The Chinese have undoubtedly taken note of the way things have played out for the Russians. This may cause them to think twice before trying to invade Taiwan.

- Stock valuations are more attractive. The recent pullback in Q1 has resulted in more attractive stock valuations which generally tend to result in higher long-term expected returns.

- Fixed income is more attractive than before. With 10-year Treasury yields now at 2.32%, compared to 0.52% on 8/4/20, higher yields now allow fixed income to actually produce some income.

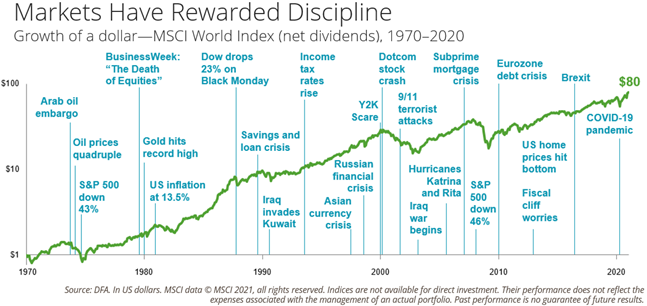

Of course, there remain risks (stagflation, escalation by Russia, the Fed over-tightens), but there are many reasons to be optimistic. The labor market is strong, supply chains continue to heal, consumer balance sheets remain in great shape, durable goods orders are high, and corporate profits are at all-time highs and are expected to continue growing. While periods of volatility can be intimidating, it’s important for investors to stay focused on their long-term investment horizon and maintain discipline. Investors often realize many years later that the investments they made during the largest market declines are the ones that had the greatest returns.